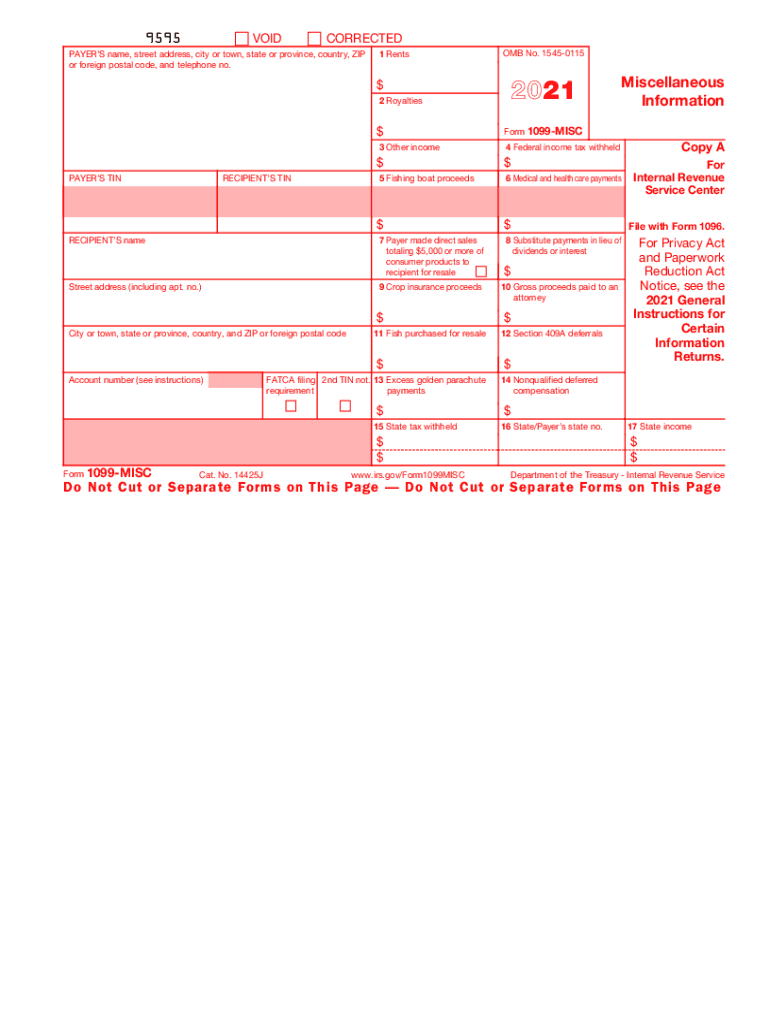

1099 Filing Electronically 2021-2024 Form

What makes the 1099 fill out legally binding?

As the world takes a step away from in-office work, the completion of paperwork increasingly happens online. The w1099 form isn’t an any different. Dealing with it using electronic tools is different from doing this in the physical world.

An eDocument can be viewed as legally binding given that specific needs are satisfied. They are especially critical when it comes to stipulations and signatures associated with them. Entering your initials or full name alone will not guarantee that the institution requesting the form or a court would consider it executed. You need a trustworthy tool, like airSlate SignNow that provides a signer with a electronic certificate. In addition to that, airSlate SignNow maintains compliance with ESIGN, UETA, and eIDAS - leading legal frameworks for eSignatures.

How to protect your 1099 when completing it online?

Compliance with eSignature regulations is only a fraction of what airSlate SignNow can offer to make form execution legitimate and safe. In addition, it offers a lot of opportunities for smooth completion security wise. Let's quickly run through them so that you can stay certain that your miscellaneous income remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are set to protect online user data and payment information.

- FERPA, CCPA, HIPAA, and GDPR: key privacy regulations in the USA and Europe.

- Two-factor authentication: provides an extra layer of security and validates other parties' identities via additional means, like a Text message or phone call.

- Audit Trail: serves to capture and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: sends the data securely to the servers.

Completing the irs forms get with airSlate SignNow will give greater confidence that the output template will be legally binding and safeguarded.

Quick guide on how to complete irs forms get

Complete 1099 form 2017 effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals alike. It serves as an excellent environmentally-friendly alternative to conventional printed and signed documentation, as you can access the appropriate template and securely archive it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Manage 2018 tax on any device using the airSlate SignNow applications for Android or iOS, and enhance any document-related process today.

The easiest way to modify and electronically sign 2018 1099 form effortlessly

- Locate download 1099 misc form and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize relevant parts of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to confirm your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, invite link, or download to your computer.

Say goodbye to lost or misplaced documents, laborious form searches, or errors that necessitate reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign 1099 misc and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Video instructions and help with filling out and completing Form 1099 MISC Miscellaneous Income

Instructions and help about 1099 form 2017

Find and fill out the correct 2018 tax

Related searches to download 1099 misc form

Create this form in 5 minutes!

How to create an eSignature for the 1099 misc

The best way to make an electronic signature for your PDF document in the online mode

The best way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to generate an e-signature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

The way to generate an e-signature for a PDF file on Android devices

People also ask forms 2018 form

-

How do I report 1099 miscellaneous income?

Generally, report this amount from Form 1099-MISC Miscellaneous Income, Box 3 on the Other Income line of Schedule 1 (Form 1040) Additional Income and Adjustments to Income, Line 8.

-

What does the IRS consider miscellaneous income?

The Bottom Line Business payers use Form 1099-MISC to report certain types of miscellaneous compensation, such as rent, prizes, awards, healthcare payments, and payments to an attorney to the IRS and to the recipients of those payments. Recipients are required to report the payments as income on their tax returns.

-

How much miscellaneous income do I have to claim?

You report instances where these payments equal $600 or more during the year. You must also file Form 1099-MISC for each person from whom you've withheld any federal income tax under backup withholding rules, regardless of the payment amount.

-

What are IRS miscellaneous deductions?

IRS Publication 529 explains which expenses you can claim as miscellaneous itemized deductions on Schedule A of Form 1040 or Form 1040NR. Miscellaneous itemized deductions are those deductions that would have been subject to the 2% of adjusted gross income limitation.

-

How does 1099-MISC affect my taxes?

Do you pay taxes on a 1099-MISC form? Simply receiving a 1099-MISC form doesn't necessarily mean you owe taxes on that money. You might have deductions that offset the income, for example, or some or all of it might be sheltered based on characteristics of the asset that generated it.

-

What types of income are reported on 1099-Misc?

Examples of payments reported on a 1099-MISC form include: Research Subjects (travel/mileage expenses are not reportable) Rents. Royalties. Prizes. Awards. Legal Services. Medical / Dental Services. Guest Speakers / Lectures.

-

What is included in miscellaneous income?

Prizes and awards. Other income payments. Medical and health care payments. Crop insurance proceeds.

-

What are examples of miscellaneous income?

About Form 1099-MISC, Miscellaneous Information Rents. Prizes and awards. Other income payments. Medical and health care payments. Crop insurance proceeds. Cash payments for fish (or other aquatic life) you purchase from anyone engaged in the trade or business of catching fish.

Get more for irs get forms

- School power of attorney form texas pflugerville isd

- Rule nisi georgialegalaidorg form

- Physician hospital discharge summarydoc wiki siframework form

- Cv coversheet form

- Wellstar financial assistance form

- Ncui 506e 2014 2019 form

- Antrag auf erteilung eines schengen application for schengen visumvisums online form

- Sc 224 form

Find out other 2018 downloadable 1099 form

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement